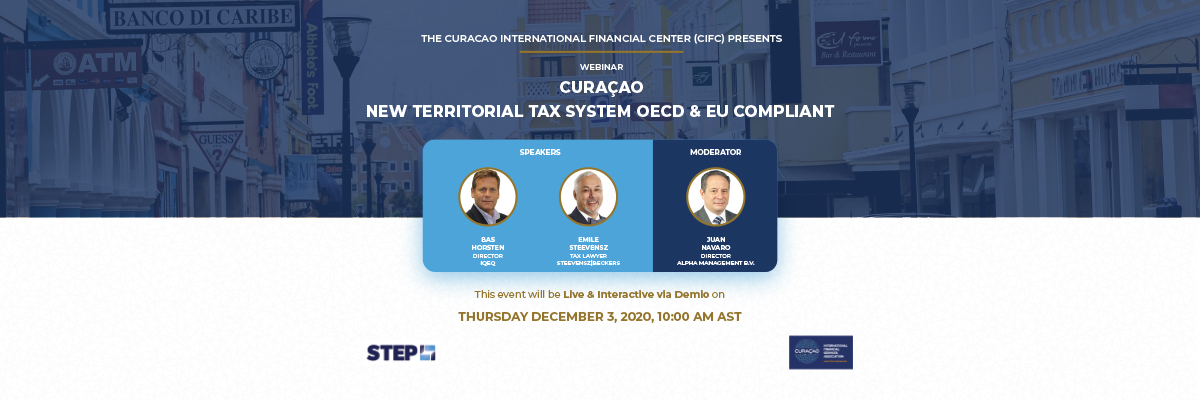

Curaçao New Territorial Tax System. OECD & EU Compliant

The Curaçao International Financial Center (CIFC) together with CIFA & STEP organizes an informative webinar series focused on Latin America.

This webinar series will shed light on the jurisdiction Curaçao and its financial services & solutions which combined with a pleasant and safe living environment makes it an indispensable jurisdiction for tax advice considerations for clients who seek premium and solid wealth security and asset protection.

With Curaçao’s new OECD & EU compliant tax system and historic (juridical) stability of the Dutch kingdom, Curaçao offers structured tailored solutions to internationally operating companies and to clients who are struggling with assets and wealth transfer questions.

Leading practitioners will cover topics such as: Curaçao’s renewed tax system, (multi) family offices and fund management in a jurisdiction both geographically and culturally close, investment opportunities through the interaction between the tax treaties of the Netherlands (Europe) & Curaçao, and more.